The Law of the First:

Crossing the Dual-Hurdle of Ecosystemic Sovereignty

and Sustained Innovation Executional Substrate for Irreversible-Enduring Growth

Author

Dr. Young D. Lee

Principal, NYET – New York Institute of Entrepreneurship and Technology®

Contact: Dr.Lee@ket-nyet.org

Abstract

Why do some leaders endure while others, once celebrated, recede into historical footnotes? Conventional explanations—market share, brand equity, technological prowess—illuminate temporary prominence but fail to explain permanence. Nokia once dominated mobile handsets; Kodak defined imaging; Sears pioneered retail. Each was “first,” yet none remained sovereign. This persistent puzzle requires a structural principle: The Law of the First.

We propose that durable leadership emerges only when actors simultaneously surmount two interdependent hurdles. Ecosystemic Sovereignty (ESv) denotes the authority to set rules, standards, and governance architectures across ecosystems, insulating the leader from structural subordination. Sustained Innovation Executional Substrate (SIES) refers to the institutionalized, resilient, and scalable foundation—capital, infrastructures, routines, and policy linkages—that transforms execution into permanence.

Neither dimension suffices alone. Sovereignty without sustainability degenerates into fragility; sustainability without sovereignty collapses into subordination. Only their conjunction generates Ecosystemic Irreversibility™: self-reinforcing, path-dependent trajectories that render leadership strategically unassailable.

We formalize this principle in the Dual-Hurdle Matrix (Exhibit 1), validate it through sectoral dominance structures (Exhibit 2), and illustrate its operation across levels—firm, university, region, nation (Exhibit 3). We conclude with prescriptive playbooks (Exhibit 4) that translate theory into strategic action. In a world increasingly governed by winner-takes-most dynamics, The Law of the First is not a choice but a structural imperative.

Introduction: From Prominence to Permanence

History is replete with fallen giants. Nokia once dictated mobile telephony standards; Kodak defined the field of imaging; Sears commanded retail. Each appeared invincible at its peak—yet all collapsed despite formidable scale, brand equity, and sustained R&D investment. Their decline is not anomalous but symptomatic of a broader paradox: prominence does not equal permanence.

Traditional explanations illuminate only fragments of the puzzle. Market share captures scale but not sovereignty: it tells us who sells the most, not who governs the rules of interaction. Brand equity conveys visibility but not durability: it fosters recognition, but recognition can evaporate when infrastructures shift. R&D intensity signals innovative capacity, yet innovation without embedding lacks irreversibility. The history of strategy is thus marked by an enduring gap between the factors that create temporary prominence and those that sustain long-term leadership.

This recurring pattern—organizations rising to dominance only to falter under systemic shocks, technological discontinuities, or institutional voids—demands a structural account. Our thesis is that endurance hinges on overcoming two interdependent hurdles: securing Ecosystemic Sovereignty (ESv) and embedding a Sustained Innovation Executional Substrate (SIES). Neither, in isolation, is sufficient. Sovereignty without sustainability produces fragility; sustainability without sovereignty entrenches subordination. Only their conjunction transforms leadership from contingent to irreversible.

The Dual-Hurdle Matrix (Exhibit 1) formalizes this principle. More than a heuristic, it provides a diagnostic lens to assess current positioning and a prescriptive roadmap for navigating increasingly concentrated, winner-takes-most environments. The next section develops the theoretical foundations of ESv and SIES, situating them within—and extending beyond—classical literatures on ecosystems, network effects, dynamic capabilities, and institutional resilience.

Theoretical Foundations

Ecosystemic Sovereignty (ESv)

Sovereignty is not mere operational independence but rule-setting authority: the capacity to define standards, shape interfaces, and capture disproportionate value from complementarities. Microsoft’s enduring dominance in operating systems, NVIDIA’s CUDA as the executional grammar of AI computing, and Visa’s global payment rails exemplify this sovereign capacity.

In theoretical lineage, ESv extends Moore’s (1993) original ecosystem metaphor, Adner’s (2017) “ecosystems-as-structure” perspective, and Jacobides, Cennamo & Gawer’s (2018) focus on governance and value capture. Together, these works shift the central question from who participates in ecosystems to who orchestrates and governs the rules of participation.

Recent contributions sharpen this lens.

- Gawer (2020, Academy of Management Discoveries) highlights platform firms’ evolution from intermediaries to “regulatory infrastructures.”

- Autio & Thomas (2020, Academy of Management Perspectives) emphasize ecosystem orchestration as a strategic capability distinct from firm-level advantage.

- Helfat & Raubitschek (2021, Strategic Management Journal) examine complementor alignment and the sustainability of platform leadership.

- Eisenmann (2023, HBS Working Paper) underscores governance conflicts in AI ecosystems, showing how sovereignty emerges not only through technical standards but also through data control.

Thus, ESv synthesizes classical and contemporary insights to denote the structural authority to orchestrate, govern, and capture value in ecosystems.

Sustained Innovation Executional Substrate (SIES)

SIES refers to the institutionalized, durable foundation of execution: financial architectures, resilient infrastructures, organizational routines, learning systems, and embedded policy supports. It is the substrate that transforms capabilities into irreversible trajectories of growth.

The concept builds on Teece’s (1997, 2018) dynamic capabilities framework, Nelson & Winter’s (1982) evolutionary theory of routines, and North’s (1990) institutional theory of embeddedness. Unlike transient resources, SES ensures continuity under shocks, scalability across time, and resilience in the face of systemic disruptions.

Recent research reinforces this view:

- Bergek, Jacobsson & Hekkert (2020, Research Policy) on technological innovation systems highlight policy-anchored infrastructures as enabling continuity.

- Manyika et al. (2021, McKinsey Global Institute) document digital infrastructures as long-lived substrates shaping national competitiveness.

- Henfridsson & Bygstad (2022, MIS Quarterly) conceptualize digital infrastructures as “generative substrates” enabling systemic resilience.

- Gkeredakis, Barrett & Oborn (2021, Organization Science) analyze resilience mechanisms under systemic shocks such as COVID-19, linking institutional embedding to sustained execution.

- OECD (2023, Digital Economy Outlook) frames national cloud and data infrastructures as executional substrates with policy-embedded durability.

SES, therefore, extends dynamic capabilities into infrastructural and institutional domains, emphasizing endurance under uncertainty and irreversibility under systemic stress.

Complementarity and Distinction

The two constructs are analytically distinct yet structurally interdependent:

- ESv answers: who governs?

- SIES answers: how durable is governance?

Historical contrasts illustrate the distinction. Nokia once enjoyed ecosystemal sovereignty through its control of mobile telephony standards but lacked a sustainable substrate of capital, developer lock-in, and institutionalized routines—rendering it fragile. Conversely, Foxconn demonstrates a formidable substrate of manufacturing routines and scale, yet without sovereignty it remains a subordinated executor within Apple’s ecosystem.

Only the conjunction of ESv and SIES yields Ecosystemic Irreversibility™: growth trajectories that are self-reinforcing, strategically unassailable, and path-dependent to the point of effective irreversibility.

The Dual-Hurdle Matrix

The Dual-Hurdle Matrix emerges from the recognition that neither Ecosystemic Sovereignty (ESv) nor Sustained Innovation Executional Substrate (SIES), in isolation, suffices to explain the durability of leadership. ESv captures the sovereign authority of firms, universities, regions, or nations to design and govern their own innovation ecosystems—anchored in Moore’s (1993) ecology of business, Adner’s (2017) ecosystems-as-structure, and Jacobides et al.’s (2018) governance lens. Yet sovereignty without institutional reinforcement is brittle. Conversely, SIES denotes the resilient and scalable foundation of execution—capital systems, infrastructures, organizational routines, and policy embeds—grounded in Teece’s (1997) dynamic capabilities, Nelson & Winter’s (1982) evolutionary routines, and institutional theories of infrastructural embedding. But substrate without sovereignty reduces actors to efficient subordinates within someone else’s system. By situating these two constructs as analytically independent yet empirically interdependent, the Matrix formalizes why enduring growth requires both: ESv defines who orchestrates; SIES defines how governance endures. Their conjunction yields Ecosystemic Irreversibility™—self-reinforcing growth trajectories that become strategically unassailable.

Conceptual Insight

The Matrix crystallizes the logic of the Dual-Hurdle Law: leadership durability emerges not from sovereignty or substrate in isolation, but from their conjunction. Each quadrant reflects a distinct strategic condition:

- Sovereign but Fragile: a paradoxical position. Entities appear dominant but collapse rapidly when deprived of capital depth, infrastructural resilience, or policy support.

- Subordinated Executor: executionally robust yet strategically dependent. They may dominate supply chains or service layers, but their fate is dictated by the sovereign orchestrator.

- Dependency State: peripheral and externally governed. Without sovereignty or substrate, actors remain price-takers and strategically irrelevant.

- Sovereign & Sustainable: the target zone. Here, sovereignty is institutionally reinforced, allowing leadership not only to persist but to amplify over time.

Dynamic Pathways

The Matrix is not static. Actors migrate across quadrants through strategic actions and policy choices:

- Subordinated Executor → Sovereign & Sustainable: requires capturing rule-setting authority—e.g., by establishing proprietary platforms, standards, or interfaces.

- Sovereign but Fragile → Sovereign & Sustainable: requires institutionalizing durability—e.g., securing deep capital pools, infrastructural autonomy, resilient routines, and embedding within policy or procurement frameworks.

- Dependency → Sovereign & Sustainable: requires leapfrogging—e.g., industrial policies or alliances that construct sovereignty and substrate simultaneously.

Strategic Significance

The Dual-Hurdle Matrix thus functions simultaneously as:

- A Diagnostic Lens: locating where an actor currently resides in the sovereignty–substrate space.

- A Prescriptive Roadmap: clarifying the distinct pathways toward irreversibility.

- A Structural Law: formalizing why enduring leadership is rare, and why those who cross both hurdles consolidate disproportionate advantage.

In effect, the Matrix demonstrates that the path from prominence to permanence is not linear but conditional—dependent on overcoming both hurdles in tandem.

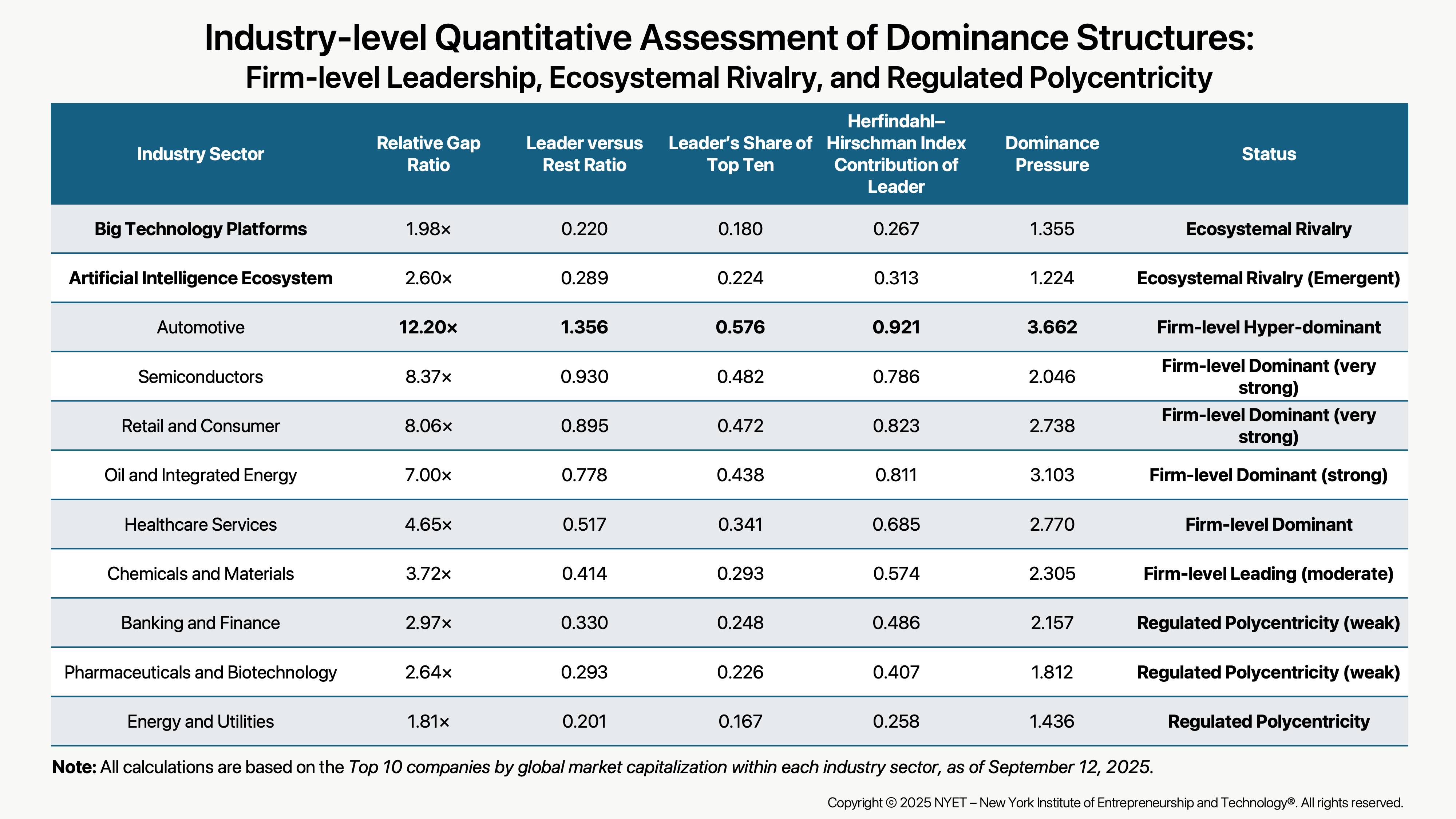

🔜 Transition to Exhibit 2: To move beyond conceptual clarity, we must test whether this logic holds empirically across industries. Sectoral concentration analyses of the world’s top ten firms (as of September 2025) reveal three distinct dominance structures—Firm-Level Leadership, Ecosystemic Rivalry, and Regulated Polycentricity—that map directly onto the Dual-Hurdle framework.

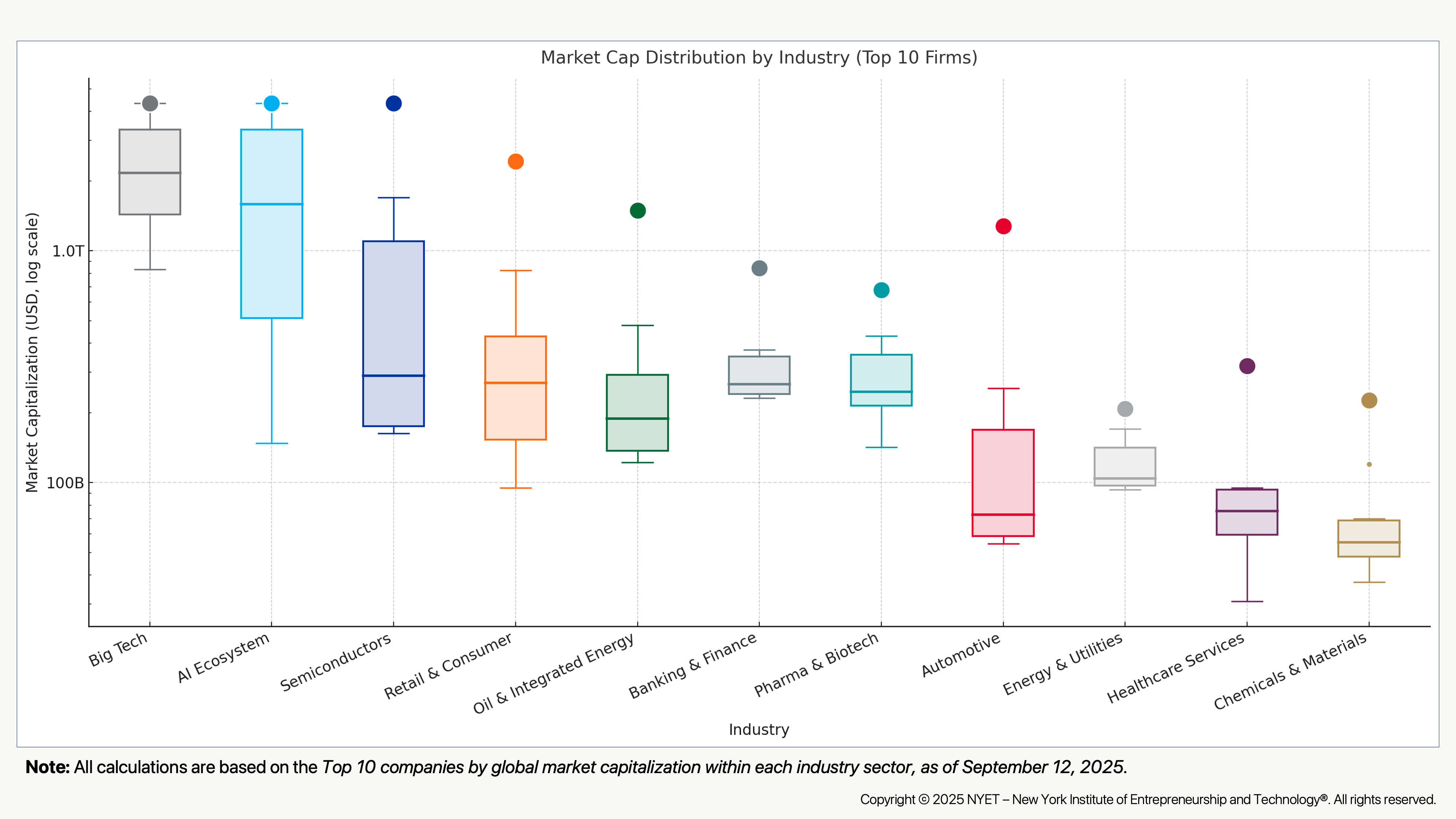

Industry-Level Evidence: Concentration Dynamics across 11 Sectors

To test the validity of the Dual-Hurdle Law empirically, we analyzed the top ten firms by market capitalization across eleven major industries (September 2025). Metrics included: Relative Gap Ratio (Gap_rel), Leader vs. Rest Ratio, Leader’s Share of Top Ten, HHI Contribution of Leader, and Dominance Pressure (DP).

The results reveal not just variation in concentration, but a typology of dominance structures: Firm-Level Dominance, Ecosystemal Rivalry, and Regulated Polycentricity.

Interpretation and Insights

Firm-Level Dominance: Traditional Industries Turning Ecosystemal

- Automotive: Tesla has converted a product-based sector into an ecosystemal contest by integrating EV hardware, charging infrastructure, OTA software, and autonomous driving data.

- Retail & Consumer: Amazon’s e-commerce, AWS, and Prime platform bundle have converted scale into sovereignty, relegating Walmart to subordinated executor status.

- Semiconductors: NVIDIA (CUDA) and TSMC (foundry) illustrate ESv + SES convergence. Their dominance is threatened only by geopolitical fracture, not by firm-level rivals.

- Oil & Energy: dominance rests less on ESv than on infrastructural SES and geopolitical entrenchment.

Ecosystemal Rivalry: Competition at the Level of Ecosystems

- Big Technology Platforms: Apple, Google, Microsoft, Amazon, Meta each govern sovereign ecosystems. Industry-level polycentricity masks the deeper logic: competition unfolds ecosystem versus ecosystem, not firm versus firm.

- Artificial Intelligence Ecosystem: still emergent. OpenAI, DeepMind, Anthropic, NVIDIA, Microsoft contest for sovereignty; SES (compute, regulation, global infrastructure) remains incomplete, yielding fragile rivalry.

Regulated Polycentricity: Policy as Counter-Substrate

- Banking & Finance: even dominant actors such as JPMorgan Chase face structural caps from regulation, systemic risk frameworks, and central-bank governance.

- Pharma & Biotech: scientific uncertainty, IP cycles, and regulatory approvals fragment sovereignty. Pfizer or Moderna may dominate temporarily, but irreversibility is structurally prevented.

- Energy & Utilities: utilities such as Duke Energy or EDF operate under policy-imposed ceilings; sovereignty is structurally impossible.

Core Insight

The evidence demonstrates that:

- Firm-Level Dominance still characterizes many traditional industries, but increasingly through ecosystemal strategies rather than product- or scale-based advantages.

- Ecosystemal Rivalry defines the leading edge of technology and AI, requiring a shift in analytical unit from firms to ecosystems.

- Regulated Polycentricity highlights how policy can act as a countervailing substrate, preventing any single firm from achieving irreversibility.

In short, concentration metrics do more than quantify competition—they reveal the structural locus of dominance, whether at the level of firms, ecosystems, or regulatory architectures.

🔜 Transition to Exhibit 3: While sector-level concentration confirms the Dual-Hurdle Law’s structural logic, it remains abstract. To uncover the mechanisms of ESv–SES interaction, we must examine multi-level cases—from firm to university, region, and nation—where sovereignty and substrate combine to yield Ecosystemal Irreversibility™.

Case Illustrations: From Firm to Nation

To ground the Dual-Hurdle Law in real-world dynamics, we examine four levels of analysis—firm, university, region, and nation—where sovereignty and substrate interact to generate Ecosystemic Irreversibility™. Each case follows the same logic: Ecosystemic Sovereignty (ESv) → Sustained Innovation Executional Substrate (SES) → Interaction → Irreversibility.

1. NVIDIA (Firm)

- ESv (Sovereignty): NVIDIA’s CUDA platform has become the de facto executional grammar for AI computation. By setting the rules of GPU programming and locking in developers through proprietary toolchains, NVIDIA exercises rule-setting sovereignty over the AI stack.

- SIES (Substrate): NVIDIA has continuously reinvested in R&D intensity (30%+ of revenue), massive CapEx in chip design, and global foundry partnerships (notably TSMC). Its SES is reinforced by U.S. industrial policy (CHIPS Act) and alliances with hyperscalers.

- Interaction: CUDA sovereignty is inseparable from sustained infrastructural and capital embedding. The firm’s governance of AI computation would collapse without continuous substrate reinforcement.

- Irreversibility: NVIDIA’s dominance is now path-dependent and strategically unassailable. Competing ecosystems (AMD ROCm, Intel OneAPI) face prohibitive switching costs. CUDA has achieved Ecosystemal Irreversibility™ at the firm level.

2. Stanford University (University)

- ESv (Sovereignty): Stanford governs the rules of knowledge valorization through intellectual property policies, licensing practices, and the orchestration of spin-outs in Silicon Valley. Its brand functions as a sovereignty marker in global academia.

- SIES (Substrate): A $40B+ endowment, alumni networks, and institutionalized venture channels (e.g., StartX, Stanford Technology Ventures Program) serve as a durable substrate, enabling knowledge orchestration to persist across generations.

- Interaction: The university’s sovereignty over IP rules is amplified by the scale and resilience of its endowment-driven SES. Unlike peer institutions with weaker financial substrates, Stanford’s governance of innovation ecosystems remains robust under shocks.

- Irreversibility: Stanford operates as a sovereign knowledge orchestrator, embedding itself as the central node in global innovation. Its model is structurally difficult to replicate, yielding irreversibility at the university level.

3. Silicon Valley (Region)

- ESv (Sovereignty): The Valley governs entrepreneurial norms and venture logics: equity-based financing, founder control models, and “move fast and break things” innovation tempo. These norms set global standards of participation.

- SIES (Substrate): Decades of venture capital agglomeration, legal infrastructure (Bayh–Dole Act, IP law, bankruptcy codes), and technological infrastructures (fiber backbones, datacenters) have created a durable substrate.

- Interaction: Normative sovereignty is reinforced by infrastructural embedding. The Valley’s governance logic could not persist without venture-finance density, supportive legal frameworks, and public procurement channels.

- Irreversibility: Silicon Valley is not simply vibrant but territorially entrenched: attempts to replicate it (e.g., in Europe or Asia) have largely produced partial imitations, not structural rivals. The region illustrates territorial irreversibility.

4. The United States (Nation)

- ESv (Sovereignty): The U.S. defines global technological and institutional standards—from internet protocols (TCP/IP) to semiconductor architectures and AI safety norms. Its sovereignty rests on standard-setting capacity across multiple industries.

- SIES (Substrate): A deep substrate of capital markets, federal procurement (DoD, DoE, NASA), world-class universities, and innovation infrastructures reinforces sovereign authority. Policies such as the CHIPS and Science Act (2022) and IRA (2022) further institutionalize durability.

- Interaction: Sovereignty over standards is continually amplified by the substrate of procurement and capital depth. This duality prevents erosion even under geopolitical shocks.

- Irreversibility: At the national level, the U.S. achieves Ecosystemal Irreversibility™, consolidating global leadership not through firm size alone but through sovereign rule-setting plus infrastructural entrenchment.

Transition

These four cases demonstrate that the Dual-Hurdle Law operates across analytical levels—from firms to nations. What binds them is the structural logic: ESv sets the rules; SIES ensures those rules endure. Their conjunction yields irreversibility.

🔜 Next Step: Exhibit 4 — Translating these mechanisms into quadrant-specific playbooks, offering actionable prescriptions for firms, universities, regions, and nations.

Implications for Leaders: Crossing the Dual-Hurdle

The Dual-Hurdle Matrix is not merely an analytical framework; it is a prescriptive tool. Leaders—whether corporate, academic, regional, or national—must first diagnose their current quadrant position and then act deliberately to cross both hurdles. Exhibit 4 provides quadrant-specific playbooks, but its deeper significance lies in revealing that enduring leadership requires structurally distinct pathways for different actor types.

The Law of the First makes explicit that durable leadership is never the incidental by-product of organizational size, technological velocity, or reputational visibility. It emerges only when two structural conditions converge: Ecosystemic Sovereignty (ESv)—the authority to govern standards, interfaces, and value flows; and a Sustained Innovation Executional Substrate (SIES)—the institutionalized and resilient foundation that secures scalability, resilience, and irreversibility over time.

Exhibit 4 operationalizes this logic through a quadrant-based playbook, prescribing differentiated pathways for firms, universities, regions, and nations. The strategic imperative is universal yet actor-specific: diagnose the current quadrant, align sovereignty with substrate, and deliberately cross the Dual-Hurdle into the Sovereign & Sustainable zone, where Ecosystemic Irreversibility™ transforms temporary prominence into enduring permanence.

Firms — Recasting Corporate Power: From Market Scale to the Sovereign Orchestration of Ecosystems

Corporations frequently misinterpret market dominance as sovereignty, mistaking quantitative share for qualitative independence. True endurance arises only when orchestration replaces scale.

- Dependency State firms remain contract-bound suppliers with negligible bargaining power. Their only escape is a leap strategy: alliances, disruptive niches, or policy-backed interventions that simultaneously construct sovereignty and substrate.

- Subordinated Executors, exemplified by Foxconn, combine infrastructural robustness with strategic dependence. Their prescription is to capture platform sovereignty: proprietary standards, control of interfaces, and lock-in through data architectures.

- Sovereign but Fragile firms, such as Nokia prior to 2007, exercised governance but lacked SES durability. Their imperative is substrate consolidation: financial buffers, infrastructural resilience, and routinized organizational depth.

- Sovereign & Sustainable firms, epitomized by NVIDIA, achieve Ecosystemal Irreversibility™ by uniting CUDA sovereignty with sustained CapEx, developer lock-in, and policy alignment. Their mandate is expansionary—reinforcing anchors and colonizing adjacent technological domains.

Universities — From Research Prestige to the Sovereign Orchestration of Innovation Ecosystems

Academic prestige, while valuable, does not constitute sovereignty. Universities that excel in research rankings without governance authority risk remaining prestigious yet structurally subordinate.

- Dependency State universities remain teaching-focused, excluded from innovation ecosystems.

- Subordinated Executors generate world-class research but lack IP governance or translational channels, effectively serving external ecosystems. Their imperative is to institutionalize knowledge sovereignty through IP regimes, translational pipelines, and orchestrated consortia.

- Sovereign but Fragile universities hold global recognition yet lack durable endowments or alumni-finance networks. Their pathway is SES institutionalization: endowment expansion, alumni venture ecosystems, and routinized commercialization practices.

- Sovereign & Sustainable universities, exemplified by Stanford, embed IP sovereignty within deep endowments and alumni capital, achieving irreversibility as knowledge orchestrators of global innovation ecosystems.

Regions — Glocal Innovation Sovereignty: Embedding Enduring Ecosystems in Place-Based Economies

Regional ecosystems are often praised for startup vibrancy, yet vibrancy without durable substrates is reversible. Sovereignty must be simultaneously local and global—glocal—to endure.

- Dependency State regions remain externally governed, dependent on imported capital and standards.

- Subordinated Executors possess infrastructure but import governance norms. Their prescription is to codify glocal governance—venture contracts, equity allocation rules, and cultural practices that export governance instead of importing it.

- Sovereign but Fragile regions enjoy prestige but lack capital markets, legal resilience, and infrastructural anchors. Their imperative is SIES embedding: regional capital systems, legal frameworks, accelerators, and digital backbones.

- Sovereign & Sustainable regions, epitomized by Silicon Valley, demonstrate glocal irreversibility: local infrastructures and cultural practices fused with global diffusion of governance templates. Their mandate is to consolidate territorial sovereignty while exporting governance logics globally.

Nations — National Ecosystemal Sovereignty in a Global Arena: Embedding Standards, Substrates, and Strategic Autonomy

Nation-states often conflate industrial scale with sovereignty, but GDP or export volumes alone do not secure autonomy. Sovereignty requires control over global standards coupled with institutionalized substrates.

- Dependency States are trapped in externally dictated supply chains, unable to exert structural autonomy.

- Subordinated Executors command infrastructures yet remain subject to foreign governance. Their pathway is to assert sovereignty in global standard-setting bodies, deploy sovereign wealth funds, and embed conditionality into foreign participation.

- Sovereign but Fragile nations influence standards but lack supply-chain resilience or capital depth. Their imperative is SES reinforcement: procurement-driven innovation, infrastructural autonomy, and policy institutionalization.

- Sovereign & Sustainable nations, exemplified by the United States, integrate standard-setting sovereignty with capital markets, defense procurement, and innovation infrastructures. This convergence yields national irreversibility, entrenching strategic primacy in the global arena.

Strategic Imperative — From Ephemeral Prominence to Irreversible-Enduring Growth

The lesson of Exhibit 4 is categorical: crossing the Dual-Hurdle is existential, not optional.

- Firms that fail to orchestrate remain efficient executors within others’ systems.

- Universities that fail to institutionalize SES remain prestigious yet structurally subordinate.

- Regions without embedded substrates remain vibrant yet reversible.

- Nations without dual foundations remain large yet strategically dependent.

By contrast, actors that surmount both hurdles consolidate themselves as architects of order. They compel others to operate under rules they did not design, transforming temporary prominence into irreversible-enduring growth.

In the structural logic of the Law of the First, leadership is not determined by who finishes the race first, but by who constructs, governs, and sustains the road upon which all others must inevitably travel.

Conclusion: Crossing the Dual-Hurdle

Enduring leadership is never the by-product of scale, transient speed, or ephemeral visibility. It rests upon two structural foundations: the ability to secure Ecosystemic Sovereignty (ESv)—the authority to set and enforce the rules of participation—and the capacity to embed a Sustained Innovation Executional Substrate (SES)—the institutional durability to withstand shocks, scale irreversibly, and perpetuate governance over time.

The Dual-Hurdle Matrix (Exhibit 1) formalizes this principle. Our sectoral evidence (Exhibit 2) demonstrates how dominance dynamics vary across industries, while multi-level cases (Exhibit 3) show how ESv and SES interact to generate Ecosystemic Irreversibility™. The quadrant-specific playbooks (Exhibit 4) then translate these insights into prescriptive strategies for firms, universities, regions, and nations.

The logic is categorical:

- Sovereignty without durability degenerates into fragility. Rules unsupported by capital, infrastructure, or institutional routines collapse under stress.

- Durability without sovereignty reduces to subordination. Executional strength without rule-setting power leaves actors efficient but structurally dependent.

- Only by crossing both hurdles simultaneously can leaders attain Ecosystemic Irreversibility™—transforming temporary prominence into permanent, strategically unassailable leadership.

Thus, The Law of the First is the Dual-Hurdle Law. To be first, and to remain first, leaders must not only win the race of the present but also construct the road upon which all others must travel. In an era defined by winner-takes-most dynamics, this is not a tactical choice or managerial preference—it is the structural law of sustainable leadership.

References

- Adner, R. (2017). Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43(1), 39–58.

- Autio, E., & Thomas, L. D. W. (2020). Value creation in ecosystems: Insights and research promise from three disciplinary perspectives. Academy of Management Perspectives, 34(1), 5–25.

- Bain, J. S. (1956). Barriers to new competition: Their character and consequences in manufacturing industries. Harvard University Press.

- Bergek, A., Jacobsson, S., & Hekkert, M. (2020). Innovation systems: A framework for analyzing and guiding systemic change. Research Policy, 49(8), 103933.

- Eisenmann, T. (2023). Governance conflicts in AI ecosystems. Harvard Business School Working Paper.

- Gawer, A. (2020). Digital platforms’ boundaries: The interplay of firm scope, platform sides, and digital interfaces. Academy of Management Discoveries, 6(1), 26–49.

- Gkeredakis, E., Barrett, M., & Oborn, E. (2021). Dynamic resilience in the digital era: Organizational responses to COVID-19. Organization Science, 32(5), 1261–1285.

- Helfat, C. E., & Raubitschek, R. S. (2021). Dynamic capabilities in platform-based ecosystems. Strategic Management Journal, 42(1), 1–15.

- Henfridsson, O., & Bygstad, B. (2022). Generative substrates and digital infrastructures. MIS Quarterly, 46(3), 1457–1488.

- Jacobides, M. G., Cennamo, C., & Gawer, A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(8), 2255–2276.

- Katz, M. L., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75(3), 424–440.

- Manyika, J., Sneader, K., Bughin, J., Woetzel, J., & Malhotra, S. (2021). Digital globalization: The new era of global flows. McKinsey Global Institute.

- Moore, J. F. (1993). Predators and prey: A new ecology of competition. Harvard Business Review, 71(3), 75–86.

- Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Harvard University Press.

- North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

- OECD. (2023). Digital Economy Outlook 2023. Organisation for Economic Co-operation and Development.

- Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

- Rochet, J.-C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economic Association, 1(4), 990–1029.

- Teece, D. J. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

- Teece, D. J. (2018). Business models and dynamic capabilities. Long Range Planning, 51(1), 40–49.

Intellectual Property Notice

© 2025 NYET – New York Institute of Entrepreneurship and Technology®. All rights reserved.

This article, including all associated concepts, frameworks, and terminology—specifically The Law of the First™, Ecosystemal Sovereignty (ESv), Sustainable Executional Substrate (SES), and Ecosystemal Irreversibility™—constitutes proprietary intellectual property of NYET and Dr. Young D. Lee.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means—including photocopying, recording, or other electronic or mechanical methods—without prior written permission of the rights holder, except for brief quotations used in critical reviews or scholarly works for non-commercial purposes with proper citation.

The concepts articulated herein are intended for academic, strategic, and policy discourse. Any unauthorized commercial use, adaptation, or derivative work—whether in consulting, investment, government advisory, or corporate application—without explicit licensing from NYET constitutes infringement and will be subject to legal remedies under applicable intellectual property law.

For permissions, licensing, and authorized use, please contact:

Office of the Principal – NYET

Email: Dr.Lee@ket-nyet.org

Website: www.mynyet.org

Policy & Strategic Use Disclaimer

The analytical frameworks and strategic insights presented in this publication are designed for conceptual, educational, and policy-oriented purposes. While they may inform decision-making in corporate, governmental, or institutional contexts, they do not constitute direct operational, investment, legal, or policy advice.

NYET and Dr. Young D. Lee expressly disclaim any liability for actions, outcomes, or decisions made by third parties on the basis of the ideas contained herein, unless undertaken under a formal advisory or licensing agreement with NYET.

Organizations or individuals seeking to apply these frameworks in practice must obtain explicit authorization and, where appropriate, enter into a formal engagement with NYET to ensure proper contextualization, compliance, and strategic alignment.