Build or Be Subordinated:

Understanding, Engaging, and Leveraging the U.S. Innovation Ecosystem

and Executional Substrate for the Corporate Strategic Future

Author

Dr. Young D. Lee

Principal, NYET – New York Institute of Entrepreneurship and Technology®

Contact: Dr.Lee@ket-nyet.org

Executive Summary — Build or Be Subordinated

In today’s global markets, corporations do not compete on a neutral field; they operate on executional substrates — the procedural architectures of standards, update cycles, interoperability rules, and procurement frameworks — most of which they did not design. Whoever authors the substrate sets cadence, compliance, and ultimately innovation sovereignty. Value pools exhibit gravitational compression: a small cohort bends capital, demand, and profits toward its release cycles and compliance rules.

The U.S. as the Sole Substrate Exporter. The United States is the only economy to have reached the Innovation Ecosystem–Driven stage in NYET’s Global Execution-Based Growth Model Evolution. It fuses cluster–ecosystem dynamics, cross-sector network effects, global value-chain orchestration, and adaptive innovation policy into an exportable operating grammar. Once embedded, this produces Ecosystemic Irreversibility — the point at which rivals must conform to your procedures. All other advanced economies (Japan, Korea, Germany, the UK, France, China) remain Innovation-Driven: technologically advanced yet structurally dependent. These findings align with NYET’s I-10 Global Industrial Powerhouse Index™ 2025.

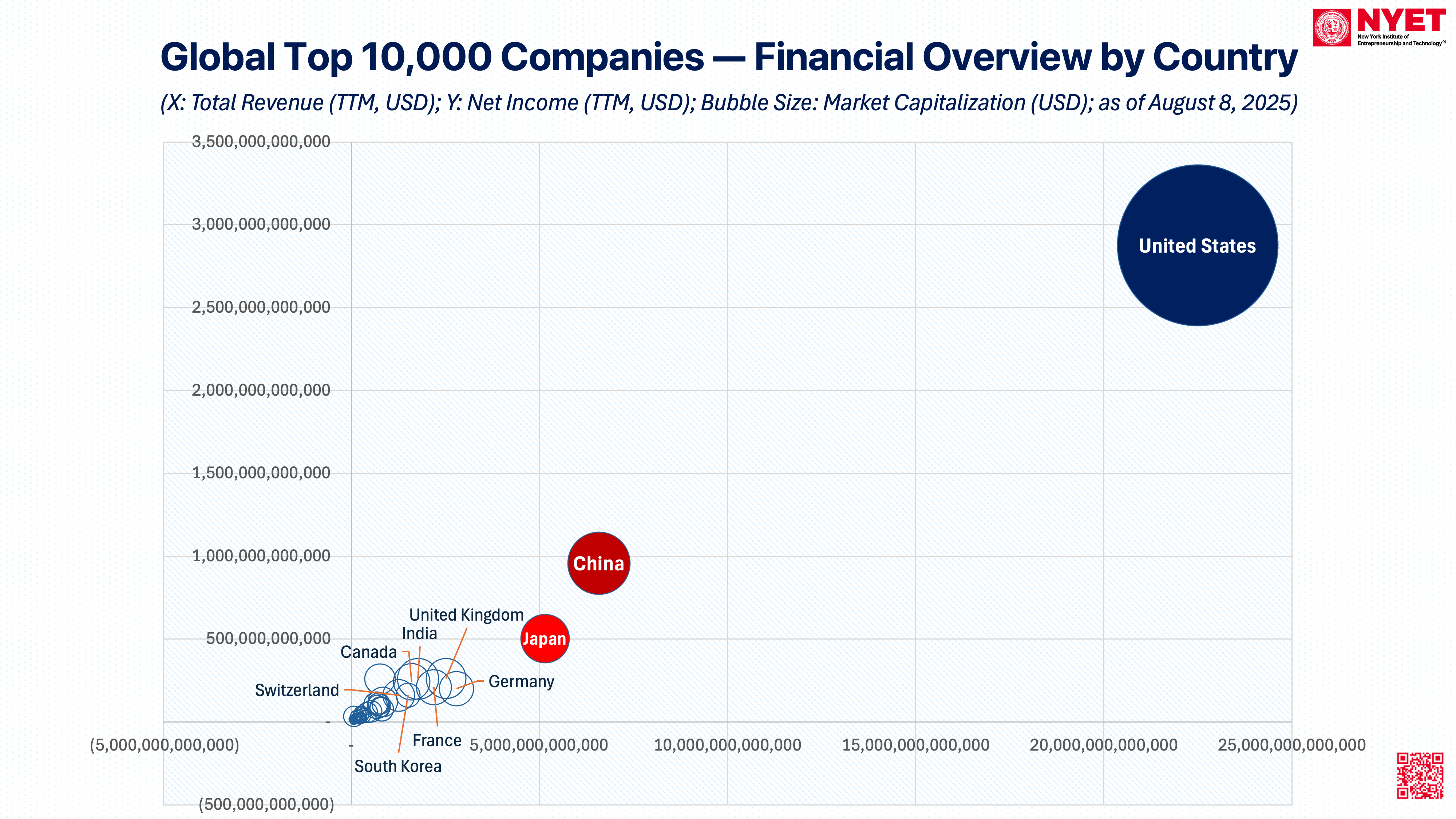

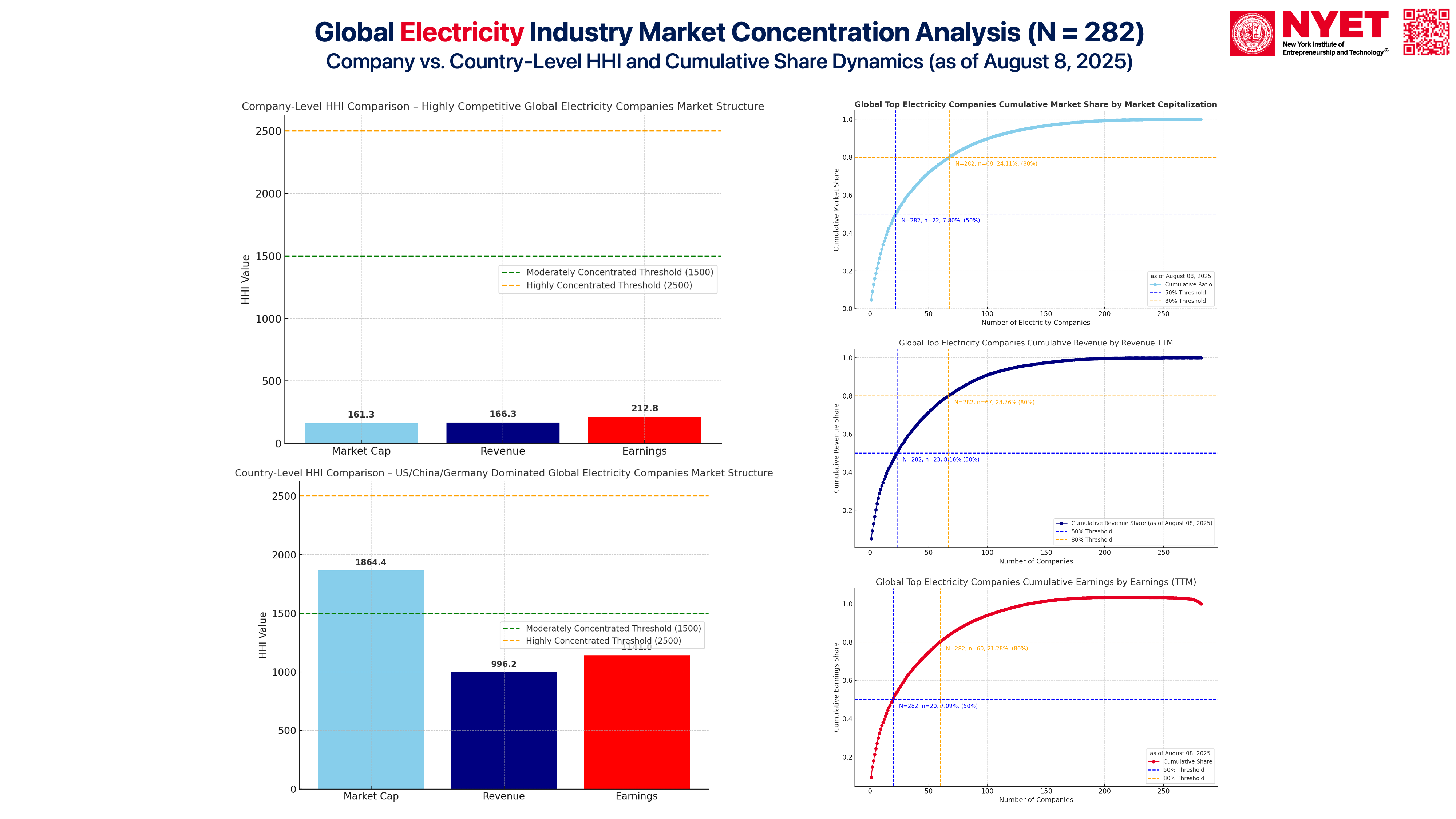

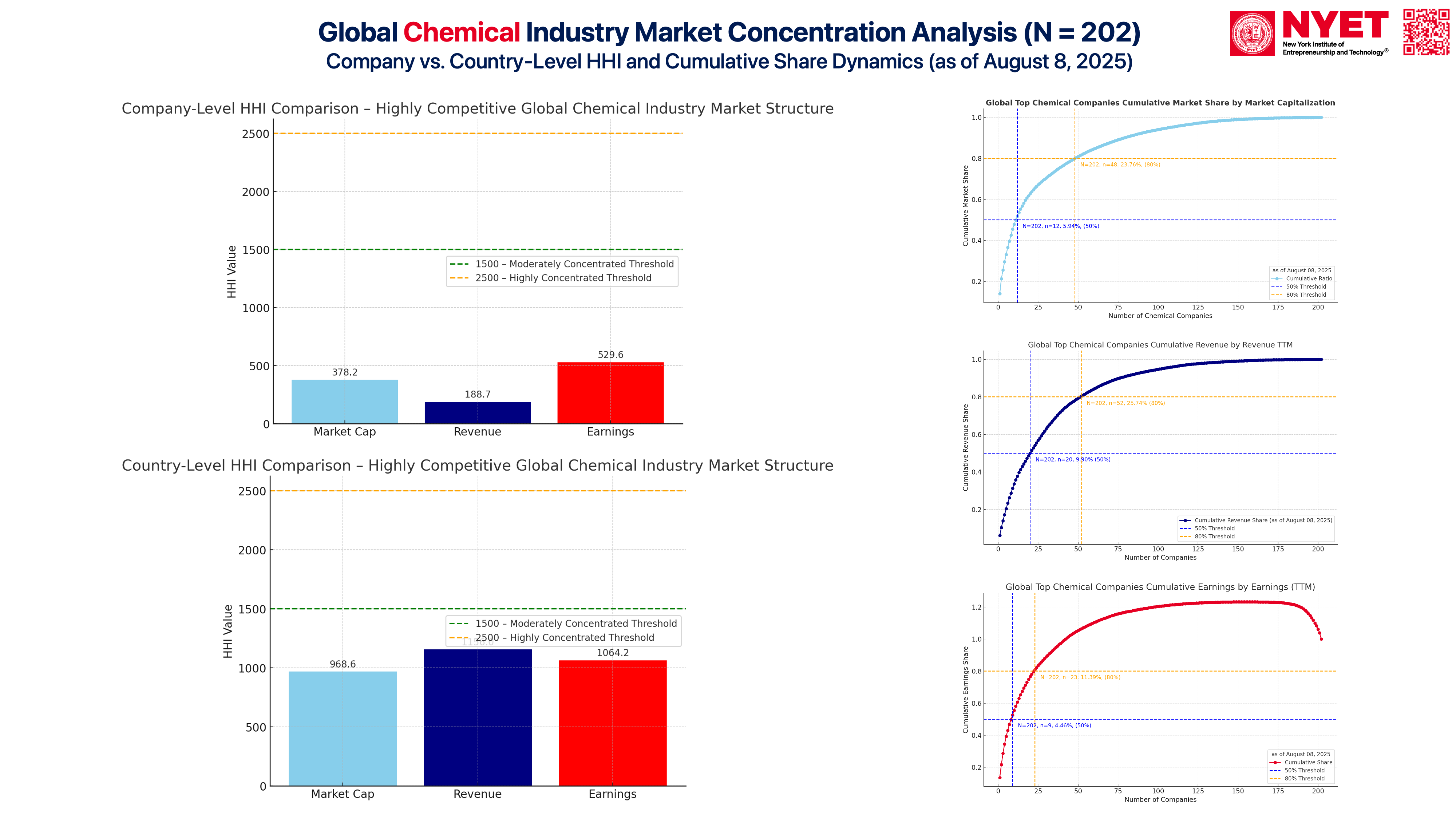

The Data: Quantified Asymmetry. NYET’s analysis of the Global Top 10,000 Companies (as of Aug 8, 2025) shows U.S. dominance across the Market Capitalization Pool, Revenue Pool, and Profit Pool. ΔHHI reveals ecosystemal amplification by sector: Technology (irreversible substrate lock-in), Semiconductors (EDA/toolchain and fabrication standards), Pharmaceuticals (regulatory and clinical trial gatekeeping), Automobiles (SDV/EV platform control points), Electricity (emerging smart-grid substrate race), Chemicals (open standards, pre-lock-in). For example, in Technology the country- vs. company-level gap (ΔHHI) is extreme — +5,784 (Market Cap), +3,548 (Revenue), +4,637 (Profit) — evidence that ecosystem control overrides firm rivalry.

Strategic Implications. Firm-level competitiveness ≠ strategic sovereignty. In high-ΔHHI sectors, foreign substrate integration is unavoidable for near-term scale; without parallel development of autonomous or regional substrates, dependency becomes irreversible. Negotiating tariff relief is tactical; architecture decides outcomes (see The Paradox of Strategic Tariff Relief).

The Corporate Playbook.

- 1–2 Years: Diagnose and diversify away from critical foreign substrate dependencies.

- 2–3 Years: Develop proprietary standards/schemas and align partner networks around them.

- 3+ Years: Embed your operational grammar in international protocols — move from compliance taker to compliance maker. (Further reading: Innovation Ecosystem as a Corporate Strategy; Ecosystemic Irreversibility)

The Binary Choice. You either host the standard or are hosted by it. In the age of ecosystemal irreversibility, delay is not strategic patience — it is surrender by default.

I. Build or Be Subordinated

In today’s global economy, your corporation is no longer competing in truly open markets.

You are operating within an Executional Substrate — a procedural architecture of standards, update cadences, and interoperability rules — that your firm did not design, yet which governs every strategic and operational decision you make.

At the national–federal level, the United States is the only economy to have reached the Innovation Ecosystem–Driven stage, as defined in NYET’s Global Execution-Based Growth Model Evolution. This stage fuses cluster–ecosystem dynamics, network effects, global value-chain orchestration, and adaptive innovation policy into a coherent, exportable operating architecture — capable of embedding U.S. procedural logic into foreign corporate, academic, regional, and national ecosystems. This is not the passive diffusion of technology standards; it is the deliberate transplantation of an operational grammar that rewires how other economies innovate, compete, and govern — often without their explicit consent.

All other advanced economies — Japan, Germany, the United Kingdom, France, South Korea, and China — remain Innovation-Driven: technologically sophisticated yet structurally dependent on a substrate authored elsewhere, with no demonstrated capacity to export their own. The asymmetry is systemic, not cyclical.

This asymmetry is visible in the data. NYET’s August 8, 2025 analysis of the Global Top 10,000 Companies shows the United States commanding the Market Capitalization Pool, Revenue Pool, and Profit Pool with gravitational dominance. On this scale, even China, despite its industrial breadth and manufacturing scale, appears mid-sized. Japan — still an engineering and manufacturing powerhouse — orbits even closer to the U.S. gravitational center, yet without the substrate export capacity to alter its trajectory. Germany, the UK, and France cluster in a narrow band, signaling advanced industrial output but entrenched reliance on external procedural architectures. South Korea, despite its technology champions, remains positioned deep within the inner orbit, exposed to foreign substrate lock-in across multiple strategic sectors.

In this configuration, negotiating marginal tariff relief with the United States is a tactical footnote — the strategic question is whose architecture underwrites your execution, and whether you can rewrite it. Whose procedures, standards, and update cycles does your global business operation actually operate under — and can you change them?

If the answer is “no,” your strategic sovereignty is already compromised — and the erosion will become irreversible unless you design, deploy, and govern your own Executional Substrate. The choice is binary. The consequences are permanent: Build — or be subordinated.

II. Industrial Concentration and Executional Substrate Leverage — Six-Sector Comparative Analysis

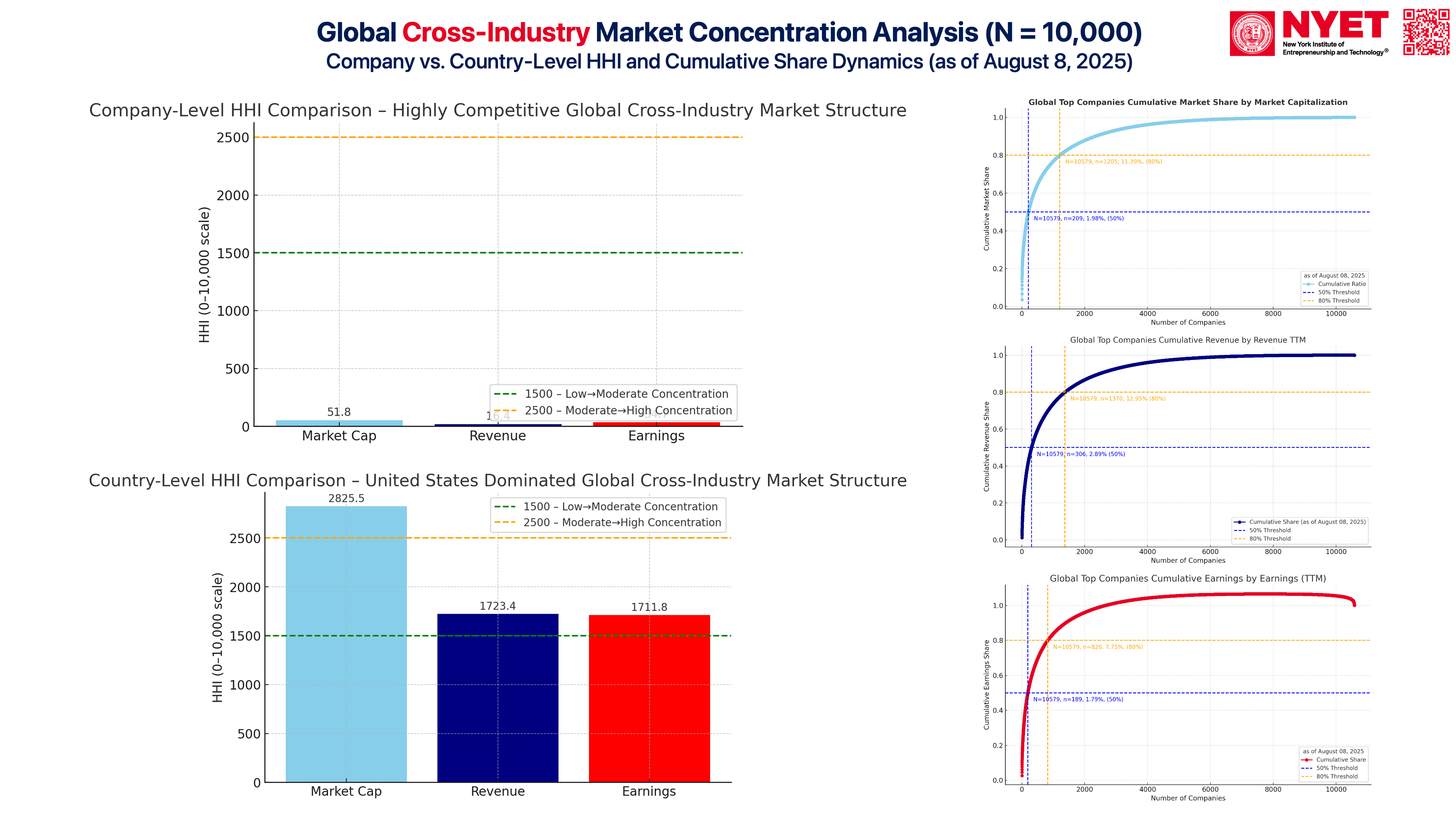

Before comparing sector-specific concentration patterns, NYET establishes the cross-industry baseline using the Global Top 10,000 Companies dataset (as of August 8, 2025). This dual-layer analysis — at both the company and country level — reveals the structural gap between firm-level competition and ecosystem-level dominance, and quantifies how national innovation ecosystems can transform competitive markets into concentrated, substrate-governed hierarchies.

Analytical Lens and Methods

We employ two integrated approaches to measure and interpret structural power:

Herfindahl–Hirschman Index (HHI)

- Company-Level HHI — Measures concentration among individual global firms across all sectors.

→ Finding: At the aggregate cross-industry level, the company-level HHI values for the Market Capitalization Pool (51.8), Revenue Pool (16.4), and Profit Pool (94.7) are far below the 1,500 “low concentration” threshold — confirming a highly competitive landscape when measured purely by firm rivalry. - Country-Level HHI — Aggregates firm data by headquarters location to capture the leverage of national innovation ecosystems.

→ Finding: At the country level, the Market Capitalization Pool HHI spikes to 2,825.5 — breaching the 2,500 “high concentration” threshold — with the U.S. as the structural anchor. The Revenue Pool (1,723.4) and Profit Pool (1,711.8) also show elevated concentration, indicating that national ecosystems are already exerting gravitational pull on value pools. - ΔHHI (Country − Company) — The gap between these measures quantifies ecosystemal leverage: how much more concentrated and dominant the market becomes when viewed through the lens of the governing ecosystem rather than individual firms.

- Market Capitalization Pool: +2,773.7

- Revenue Pool: +1,707.0

- Profit Pool: +1,617.1

Cumulative Share Distribution

Examines how many companies control 50% and 80% of each value pool:

- Market Capitalization Pool: Top 209 firms (1.98%) hold 50% of global value; 1,205 firms (11.39%) hold 80%.

- Revenue Pool: Top 306 firms (2.89%) hold 50%; 1,370 firms (12.95%) hold 80%.

- Profit Pool: Top 189 firms (1.79%) hold 50%; 820 firms (7.75%) hold 80%.

These distributions illustrate gravitational compression — where a tiny fraction of firms commands the majority of industrial value — and highlight the strategic importance of being embedded within, or authoring, the governing substrate.

Strategic Reading of the Baseline

- Firm-Level View: On paper, the global economy appears competitive, with thousands of firms vying across sectors.

- Ecosystem-Level View: In reality, the aggregation by national innovation ecosystem reveals that value is disproportionately anchored to the United States — the only Innovation Ecosystem–Driven economy in NYET’s Global Execution-Based Growth Model.

Implication: Even before disaggregating into sectors, the structural duality is visible: companies compete, but ecosystems dominate. This dominance is not accidental — it is the result of executional substrate design that scripts the operational grammar for participation across industries.

📦 Box 1 — How to Read the Herfindahl–Hirschman Index (HHI) in Strategic Terms

Definition: The HHI measures market concentration by summing the squares of each participant’s market share (on a scale from 0 to 10,000).

Interpretation Thresholds:

- < 1,500: Low concentration → Highly competitive market structure.

- 1,500–2,500: Moderate concentration → Competition exists but with notable dominant players.

- > 2,500: High concentration → Market or value pool is controlled by a small number of dominant actors.

Why NYET Uses It at Two Levels:

- Company-Level HHI — Shows rivalry among individual firms.

- Country-Level HHI — Aggregates by corporate headquarters, revealing the strategic leverage of national innovation ecosystems.

ΔHHI (Country − Company): A high ΔHHI means that a national ecosystem is amplifying firm-level competitiveness into ecosystem-level dominance — a direct indicator of Executional Substrate power.

Strategic Insight: A low company-level HHI combined with a high country-level HHI signals that, while firms appear to compete fiercely, the real control lies with the national ecosystem authoring the operational grammar of the industry.

1. Market Capitalization Pool — Control of Valuation

Company-Level Dynamics

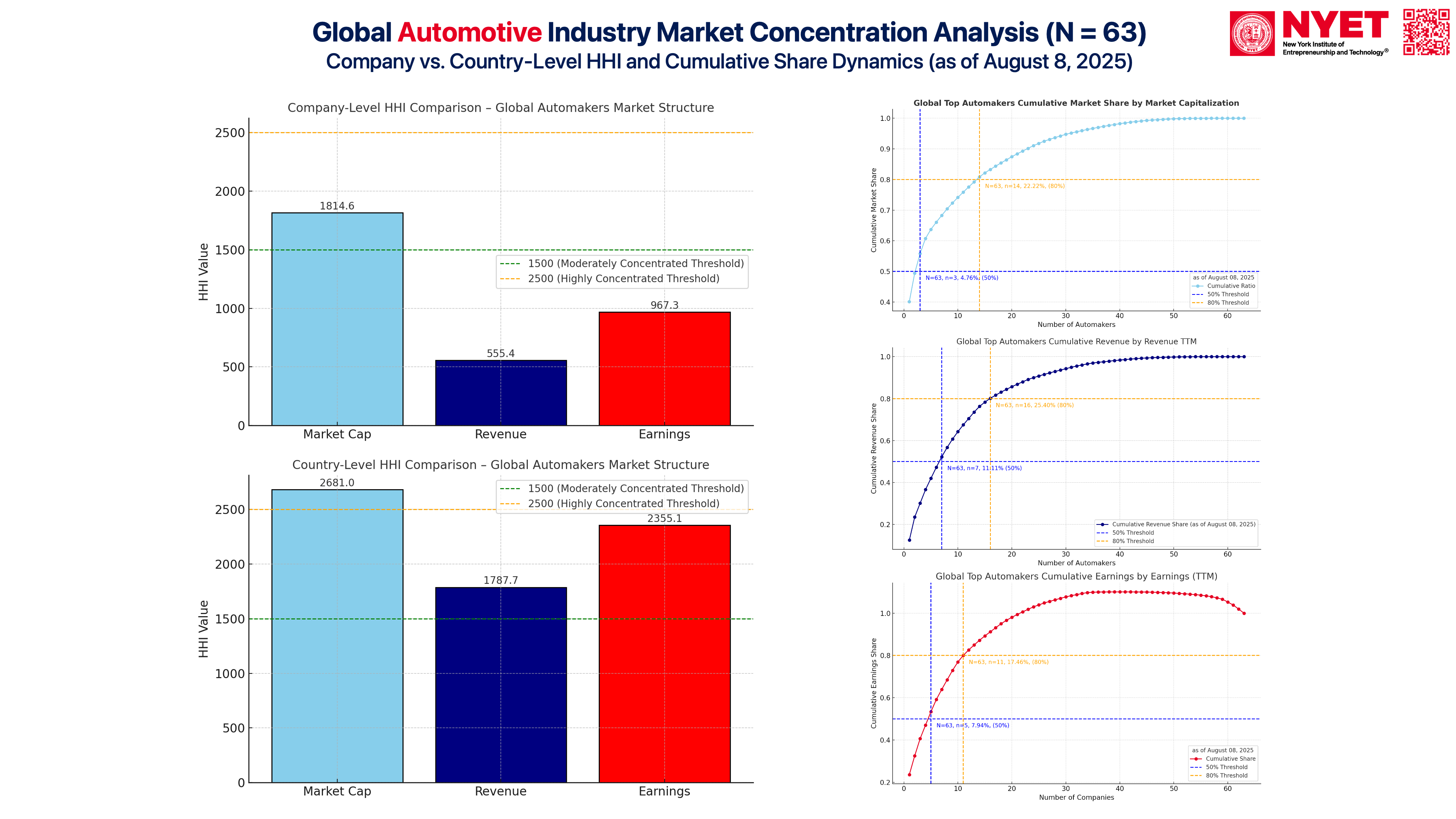

Across global sectors, only Semiconductors (HHI: 2,090.8) and Automobiles (HHI: 1,814.6) cross into moderate concentration territory, while all other industries remain within competitive thresholds by conventional HHI standards. Yet the cumulative share distribution tells a different story:

- Pharmaceuticals (N = 764): The top 11 firms—a mere 1.44% of the sector—control 50% of total market capitalization; the top 50 firms (6.54%) control 80%.

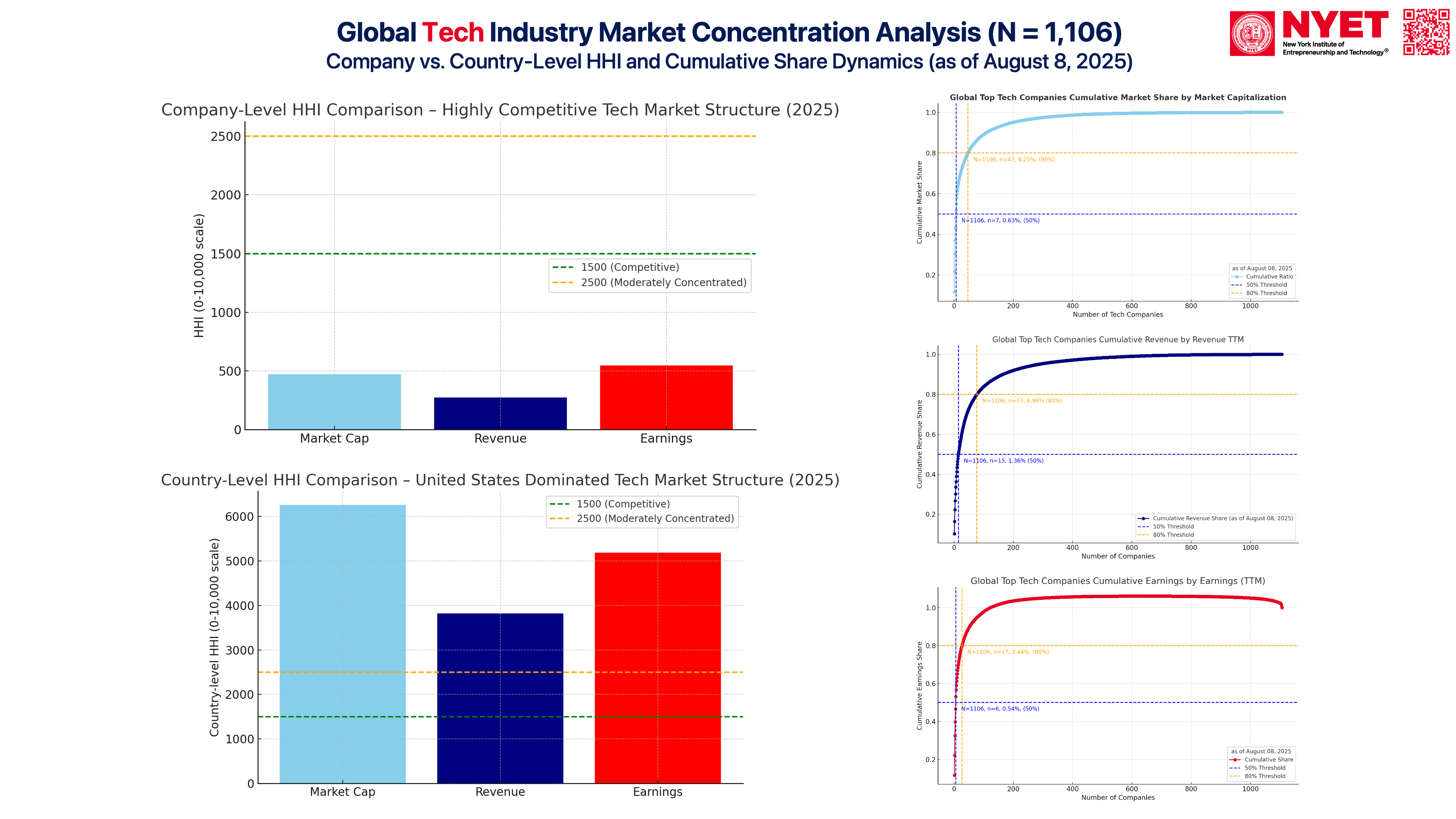

- Technology (N = 1,106): Even more compressed—7 firms (0.63%) hold 50%, and 47 firms (4.25%) hold 80%.

This concentration pattern—particularly in Technology—is structurally oligopolistic in effect, even when HHI appears “competitive” on paper.

Country-Level Dynamics

Once valuation is aggregated by headquarters nation, concentration spikes sharply:

- High Concentration: Technology (6,255.3), Semiconductors (5,387.0), Pharmaceuticals (3,059.0)—each far above the 2,500 HHI threshold.

- Near-Threshold: Automobiles (2,681.0)—poised for consolidation tipping point.

- Diffuse: Electricity (1,864.4) and Chemicals (968.6)—industrially fragmented, lacking a single national anchor.

Strategic Interpretation

Valuation leadership at the global scale is not a neutral by-product of firm-level competition. It is the deliberate consolidation of market gravity through three reinforcing mechanisms:

- Platform Dominance — Control of core digital, manufacturing, or service platforms that define market participation rules.

- Proprietary IP Regimes — Patents, standards-essential technologies, and trade-secret portfolios that form barriers to replication.

- Executional Substrate Export — The embedding of a nation’s operational grammar—update cycles, compliance protocols, interoperability standards—into foreign markets, transforming company-level advantages into ecosystem-level lock-in.

The result is a structural inversion: valuation is no longer a metric of competitive diversity but a signal of ecosystemal control, where a small cohort of firms—and their home states—dictate the valuation logic for entire sectors.

2. Revenue Pool — Control of Market Adoption

Company-Level Dynamics

Measured by the Herfindahl–Hirschman Index (HHI), all sectors register within competitive territory at the firm level—e.g., Technology (273.7), Automobiles (555.4), Semiconductors (757.2). Yet the cumulative share distribution reveals a compressed command structure:

- Pharmaceuticals (N = 764): The top 9 firms (1.18%) capture 50% of total global revenue; the top 29 firms (3.80%) account for 80%.

- Technology (N = 1,106): The top 15 firms (1.36%) control 50%; the top 77 firms (6.96%) hold 80%.

This pattern shows that while thousands of firms participate, a microscopic minority defines throughput velocity and scale.

Country-Level Dynamics

When aggregated by headquarters nation, sectoral concentration intensifies:

- High Concentration: Technology (3,822.1), Semiconductors (3,014.4), Pharmaceuticals (3,420.8)—well above the 2,500 HHI threshold, indicating ecosystem-led capture of revenue streams.

- Fragmented: Automobiles (1,787.7) and Chemicals (1,156.0)—sectors where no single national ecosystem fully dominates global revenue flows.

Strategic Interpretation

End-market demand may appear geographically diffuse, but the routes through which demand is fulfilled are strategically engineered. Three ecosystem-level mechanisms tilt the adoption curve toward substrate-origin economies:

- Procurement Pathway Design — Control over tendering frameworks, supply qualification lists, and bid evaluation criteria.

- Certification and Compliance Regimes — Mandated standards and testing protocols that serve as gatekeepers for market entry.

- Integration Architectures — Ecosystem-authored interoperability and update schedules that lock in recurring adoption cycles.

Together, these mechanisms give the originating ecosystem structural gatekeeping power—transforming diffuse global demand into controlled adoption funnels aligned with its

3. Profit Pool — Control of Surplus Capture

Company-Level Dynamics

Across all sectors, firm-level Herfindahl–Hirschman Index (HHI) scores remain within the competitive range (<1,500), though Semiconductors (1,436.0) press against the upper limit, signaling an emerging consolidation trend. Cumulative profit share analysis exposes extreme compression:

- Pharmaceuticals (N = 764): The top 5 firms (0.65%) extract 50% of global sector profits; the top 11 firms (1.44%) command 80%.

- Technology (N = 1,106): The top 6 firms (0.54%) secure 50%; the top 27 firms (2.44%) take 80%.

This indicates that surplus value accrues overwhelmingly to a microscopic elite, far more concentrated than revenue control.

Country-Level Dynamics

National ecosystem-level concentration reveals structural asymmetries:

- Dominant: Technology (5,184.9), Semiconductors (3,414.7)—sectors where surplus capture is decisively ecosystem-anchored.

- Moderate: Pharmaceuticals (1,975.7), Automobiles (2,355.1)—suggesting partial but incomplete national leverage over profit retention.

- Low: Chemicals (1,064.2), Electricity (~1,108)—where ecosystem control over surplus is minimal and competitive dispersion prevails.

Strategic Interpretation

Surplus value is not merely a by-product of competitive efficiency; it is systematically engineered at the ecosystem level through three reinforcing mechanisms:

- IP Rent Extraction — Ownership of foundational patents, proprietary algorithms, and licensing structures that enforce recurring royalty flows.

- Platform Fee Architecture — Monetization of access, transaction, and service layers embedded within the operational substrate.

- Data Monetization Loops — Ecosystem-controlled capture, processing, and resale of usage and performance data, creating compounding revenue streams.

Together, these mechanisms enable the originating ecosystem to capture and retain disproportionate profit shares—often irrespective of where sales occur—ensuring that firms operating inside a foreign-authored substrate remain dependent participants in the substrate’s monetization grammar.

4. ΔHHI — Measuring Ecosystemal Leverage

Why This Metric Matters

The preceding sections examined three distinct arenas of industrial control—valuation (market capitalization pool), adoption (revenue pool), and surplus capture (profit pool)—at both the company level and the country (ecosystem) level.

While these views reveal sector-specific patterns, they do not yet quantify a deeper strategic question:

How much more dominant does an industry become when viewed through the lens of the ecosystem that governs it, rather than the individual firms that populate it?

This is the role of ΔHHI—a meta-metric designed to measure ecosystemal leverage.

Definition and Analytical Purpose

ΔHHI is defined as the difference between the country-level HHI and the company-level HHI within the same sector and metric (market capitalization, revenue, or profit).

A high ΔHHI indicates strong ecosystemal amplification—the capacity of a national innovation ecosystem to transform the competitiveness of its firms into systemic, structural control of the global industry. This amplification is not accidental; it is deliberately engineered through executional substrate design:

- Standards that become global defaults

- Procedural grammars that define how innovation is implemented and updated

- Procurement architectures that embed these rules into international trade and industrial operations

Strategic Interpretation

ΔHHI thus serves as a direct measure of ecosystemal leverage—capturing the extent to which control is shifted from individual market actors to the ecosystem as an operational whole.

This enables sector-by-sector analysis of where ecosystemal dominance is already entrenched, where it is emerging, and where it remains contested.

5. Sector-by-Sector ΔHHI Analysis

Technology — Complete Ecosystemal Irreversibility

Key Numbers

- Company-level HHI: 273.7 (highly competitive at firm level)

- Country-level HHI: 6,255.3 (extreme national concentration)

- ΔHHI: +5,981.6 — the highest across all sectors

- 50% Market Cap Pool: Top 7 firms (0.63% of N)

- 80% Market Cap Pool: Top 47 firms (4.25% of N)

Analytical Interpretation

The immense gap between company- and country-level HHI reveals extreme ecosystemal amplification: a globally competitive firm landscape is nonetheless governed by a single national innovation ecosystem — the United States. Control points include global cloud infrastructure, operating systems, developer frameworks, and integration protocols. Once embedded, these substrates enforce Ecosystemal Irreversibility, making displacement virtually impossible without building a parallel operational grammar.

Strategic Implications

- Corporate Level: Without exporting your own operational grammar, scaling within the U.S.-authored substrate will see upstream value capture flow out of your control. Develop proprietary standards and integration layers to reclaim margin and innovation sovereignty.

- National Level: Secure active influence in global tech standards bodies and protocol governance to prevent permanent compliance positioning.

Semiconductors — Fabrication and Toolchain Lock-In

Key Numbers

- Company-level HHI: 2,090.8 (moderate concentration)

- Country-level HHI: 5,387.0 (high concentration)

- ΔHHI: +3,296.2

- 50% Market Cap Pool: Top 3 firms (0.38% of N)

- 80% Market Cap Pool: Top 13 firms (1.65% of N)

Analytical Interpretation

Semiconductors operate under a dual-layer lock-in: fabrication (fabs, process nodes) and toolchain (EDA software, metrology systems). The U.S. ecosystem dominates upstream design, verification, and measurement standards, ensuring that even fabrication leaders abroad remain dependent on American operational grammar. ΔHHI reflects how moderate firm-level concentration becomes systemic national leverage through standards and tooling monopolies.

Strategic Implications

- Corporate Level: Build proprietary design-to-tape-out pipelines; diversify EDA and metrology dependencies; engage in co-development alliances for fab and tooling sovereignty.

- National Level: Invest in independent EDA, process standards, and measurement protocols to reduce reliance on U.S.-controlled executional substrates.

Pharmaceuticals — Regulatory and Clinical Trial Sovereignty

Key Numbers

- Company-level HHI: 1,030.0 (competitive)

- Country-level HHI: 3,059.0 (high concentration)

- ΔHHI: +2,029.0

- 50% Revenue Pool: Top 9 firms (1.18% of N)

- 80% Revenue Pool: Top 29 firms (3.80% of N)

Analytical Interpretation

Manufacturing and discovery are geographically distributed, yet regulatory and clinical trial substrates — FDA frameworks, ICH guidelines — concentrate gatekeeping power in U.S.-aligned systems. High ΔHHI reflects the transformation of global R&D capacity into centralized market control via approval and certification regimes.

Strategic Implications

- Corporate Level: Engage in early-phase international trial protocol development; diversify market access by securing approvals through non-U.S./non-EMA pathways.

- National Level: Build independent regulatory–approval ecosystems with mutual recognition agreements to avoid one-way compliance dependencies.

Automobiles — SDV & EV Platform Inflection Point

Key Numbers

- Company-level HHI: 1,814.6 (moderate concentration)

- Country-level HHI: 2,681.0 (near high concentration threshold)

- ΔHHI: +866.4

- 50% Market Cap Pool: Top 5 firms (0.40% of N)

- 80% Market Cap Pool: Top 20 firms (1.58% of N)

Analytical Interpretation

The sector is transitioning from mechanical dominance to software-defined vehicle (SDV) and EV platform governance. Control over vehicle OS, battery management standards, and charging protocols will define future concentration. Moderate ΔHHI signals that the lock-in point has not yet been reached — but standard-setting now will dictate decades of trajectory.

Strategic Implications

- Corporate Level: Develop in-house or allied vehicle OS platforms; secure IP in EV infrastructure standards; integrate proprietary software stacks into product strategy.

- National Level: Lead the creation of open, interoperable SDV OS and charging standards to prevent entrenchment by foreign platforms.

Electricity — Emerging Smart Grid Substrate Race

Key Numbers

- Company-level HHI: 1,250.0 (competitive)

- Country-level HHI: 1,864.4 (diffuse)

- ΔHHI: +614.4

- 50% Revenue Pool: Top 12 firms (1.20% of N)

- 80% Revenue Pool: Top 48 firms (4.80% of N)

Analytical Interpretation

Electricity markets remain fragmented, but integration of smart grids, distributed energy resource (DER) protocols, and cross-border energy data standards is accelerating. The current low ΔHHI hides a first-mover substrate opportunity — whoever authors the operational logic of grid interconnectivity will define long-term market architecture.

Strategic Implications

- Corporate Level: Position as an early compliance–integration hub for energy IoT; develop proprietary DER management platforms aligned with emerging interoperability standards.

- National Level: Lead standardization in smart grid data formats and DER communication protocols before foreign ecosystems establish control.

Chemicals — Pre-Lock-In ESG & Compliance Standardization Opportunity

Key Numbers

- Company-level HHI: 850.0 (competitive)

- Country-level HHI: 968.6 (diffuse)

- ΔHHI: +118.6 — lowest across all sectors

- 50% Market Cap Pool: Top 15 firms (1.50% of N)

- 80% Market Cap Pool: Top 60 firms (6.00% of N)

Analytical Interpretation

The chemical sector is globally distributed with minimal ecosystemal amplification so far. However, ESG compliance, carbon accounting, and hazardous material handling standards are emerging as potential executional substrates. The sector’s low ΔHHI signals that substrate authorship is still available for proactive actors.

Strategic Implications

- Corporate Level: Integrate proprietary ESG and compliance toolsets into supply chain contracts; embed verification platforms that enforce your operational grammar.

- National Level: Export sustainability and safety standards early to set de facto norms before foreign ecosystems define them.

Strategic Synthesis — ΔHHI and Substrate Sovereignty

Technology, Semiconductors, and Pharmaceuticals are not merely market leaders but executional substrate exporters. Their operating grammar is embedded so deeply in global industry operations that it functions as the default rulebook for participation. High ΔHHI values reveal where the real competitive unit is the national ecosystem, and where firm-level performance is inseparable from ecosystem control. For Korean and Japanese corporations, this is both a diagnostic and a call to action: engage strategically with dominant foreign substrates where necessary, but build independent ones wherever possible—or risk permanent operational subordination.

Sector-by-Sector Strategic Implications

Chemicals — Distributed Structure with Pre-Lock-In Advantage

The chemical sector remains the most geographically distributed among the six, with low ΔHHI and no entrenched foreign executional substrate. ESG and carbon-accounting frameworks are emerging, but no single ecosystem controls them yet.

Strategic Imperative: Export sustainability and safety standards as de facto norms before U.S. or EU ecosystems set irreversible defaults.

Electricity — Fragmented Today, Centralized Tomorrow

Electricity generation and distribution remain fragmented globally, but convergence is imminent as smart grid protocols, distributed energy resource (DER) standards, and cross-border interoperability frameworks mature.

Strategic Imperative: Lead in protocol design through regional standardization blocs to prevent lock-in by U.S. or EU frameworks.

Automobiles — From Mechanical Dominance to Software-Defined Control

The automotive sector is shifting from mechanical engineering dominance to governance by software-defined vehicle (SDV) platforms. EV charging protocols and vehicle OS architectures are being shaped primarily by U.S. and Chinese ecosystems.

Strategic Imperative: Secure early participation in SDV and EV infrastructure standard-setting bodies to avoid relegation to hardware supply roles.

Pharmaceuticals — Regulatory and Clinical Trial Sovereignty at Stake

Manufacturing and discovery are globally distributed, but clinical trial and drug approval systems remain centralized in FDA/EMA-aligned frameworks. These operate as invisible substrates controlling innovation cadence and market access.

Strategic Imperative: Develop autonomous approval and trial infrastructures with global recognition to reduce dependency on foreign procedural control.

Semiconductors — Fully Substrate-Driven and High-Dependency Risk

From EDA tools to fabrication equipment standards, the semiconductor sector is end-to-end dependent on U.S.-origin operational grammars, creating toolchain lock-in and subordinating global production schedules to foreign release cycles.

Strategic Imperative: Build a sovereign semiconductor substrate through indigenous design tools, metrology systems, and regional fab/tooling alliances.

Technology — Apex Concentration and Irreversible Substrate Control

Technology exhibits the highest ΔHHI, with U.S.-origin API architectures, cloud hyperscale infrastructure, developer toolchains, and procurement frameworks defining competition itself.

Strategic Imperative: Integrate with the U.S. tech substrate for short-term scale while investing in counter-substrate architectures such as regional clouds, alternative APIs, and indigenous developer platforms.

Integrated Strategic Reading

Firm-level competitiveness is not equivalent to strategic sovereignty. A corporation may lead in market share, revenue, or profitability, yet remain structurally subordinate if the executional substrate governing its industry—its standards, procedural grammars, interoperability rules, and procurement frameworks—is authored externally. In such cases, participation without compliance is impossible, and compliance often cements long-term dependency.

The ΔHHI map provides a quantitative X-ray of this reality:

- High ΔHHI (Technology, Semiconductors, Pharmaceuticals) — Already under foreign substrate control; integration is essential for competitiveness, but parallel independence-building is critical for sovereignty.

- Moderate ΔHHI (Automobiles, Electricity) — Control points are shifting; influence must be secured before standards crystallize.

- Low ΔHHI (Chemicals) — Pre-lock-in stage; indigenous substrate creation is still possible.

The strategic choice is binary and time-sensitive: author the substrate, embedding domestic operational grammars into the global value chain, or operate within another’s substrate and accept that innovation cadence, compliance rules, and profit capture will be determined externally. In the age of ecosystemal irreversibility, delay is not neutrality—it is strategic surrender by default.

III. What is an Innovation Ecosystem, and How Can Corporations Build One?

Beyond Innovation Systems: Securing Substrate Sovereignty

An innovation system is a state-led, planned architecture for coordinating R&D; an innovation ecosystem is a market-led, co-evolutionary platform that co-designs the operational logic of entire industries. The former can produce world-class technology, but only the latter can export executional substrates — the procedural, interoperability, and compliance architectures that make participation conditional and give their authors structural control.

In NYET’s Global Execution-Based Growth Model, only the United States has reached the Innovation Ecosystem–Driven Economy stage, fusing cluster–ecosystem dynamics, cross-sector network effects, global value-chain orchestration, and adaptive innovation policy into an exportable operational grammar. All other advanced economies — including Japan, Germany, the UK, France, South Korea, and partially China — remain Innovation-Driven: technologically advanced yet structurally dependent on foreign-authored substrates.

Once embedded, a substrate achieves Ecosystemal Irreversibility, compelling competitors to align with its cadence, standards, and compliance logic. U.S. dominance is evident in CUDA (temporal subordination), NIST metrology standards (standards subordination), and federal procurement frameworks (compliance-driven access). Substrate exporters capture disproportionate value not by selling products alone, but by monetizing compliance and defining the very rules of participation.

Corporate Playbook for Building an Innovation Ecosystem

A corporation’s ascent to ecosystem leadership is not a linear “innovation project” but a coordinated, multi-horizon campaign. The objective is to move decisively from dependency management — operating under foreign-authored executional substrates — to market architecture ownership, where your operational grammar shapes the participation rules for others. This requires synchronized action across three temporal horizons:

Short Term (1–2 Years) — Secure the Foundations

1. Conduct Substrate Dependency Diagnostics

Map every critical operational function — from R&D toolchains and manufacturing execution systems to regulatory compliance workflows — against the procedural logic and standards they depend on. Identify dependencies controlled by foreign executional substrates, particularly in high ΔHHI sectors where the cost of lock-in compounds rapidly.

2. Prioritize Strategic Risk Reduction

Diversify away from single-source dependencies in software toolchains, interoperability standards, and regulatory certification frameworks. Address “choke points” where foreign procedural logic can delay, disable, or dictate your operational cadence, and establish contingency pathways to maintain continuity under geopolitical or supply chain disruption.

Medium Term (2–3 Years) — Build Gravitational Pull

1. Develop Proprietary Standards and Schemas

Define technical and procedural frameworks in high-leverage niches where you can set operational rules. Make them sufficiently interoperable to attract partners, but distinctive enough to embed your control logic and create competitive differentiation.

2. Build Integrated Partner Networks

Orchestrate a network of suppliers, customers, regulators, and strategic allies aligned to your proprietary standards. Aim for gravitational compression — a condition where ecosystem participants are drawn into your operational orbit, reinforcing each other’s commitment and increasing the switching cost of leaving your substrate.

Long Term (3+ Years) — Export Your Operational Grammar

1. Embed in Global Standards and Protocols

Actively engage in international standard-setting bodies and protocol governance councils to secure editing rights and rapporteur positions. Ensure that your operational grammar becomes embedded in global frameworks, transforming your role from compliance taker to compliance maker.

2. Transition to Market Architecture Ownership

Move beyond market participation to defining the architecture of participation itself. Export your executional substrate to:

- Capture ΔHHI gains at both the corporate and national levels, reinforcing your ecosystemal leverage.

- Expand your share of the Market Capitalization Pool, Revenue Pool, and Profit Pool — not only through product sales, but by writing the rules and compliance logic that govern the entire market.

Strategic Imperative: The window for authoring a substrate is finite. Once foreign operational grammars reach Ecosystemal Irreversibility in your sector, the cost of reclaiming sovereignty will rise exponentially. Integration into dominant foreign ecosystems may buy time and scale in the short term, but parallel investment in sovereign substrate development is the only route to long-term strategic independence.

From Integration to Sovereignty: The Dual Strategy Imperative

In the age of Ecosystemal Irreversibility, neutrality is a strategic illusion.

Once a foreign executional substrate governs your industry’s cadence, standards, and compliance logic, each quarter of delay compounds the economic, technological, and political cost of reclaiming autonomy.

Competitive neutrality is not a safe harbor — it is a slow-motion surrender.

The path forward requires a dual-track strategy:

Integrate where it secures immediate scale and market access, while building sovereign capacity before the authorship window closes and operational grammar becomes irreversible.

1. Controlled Integration — Access Without Abdication

Objective: Maintain near-term market presence and operational stability.

Method: Selectively align with dominant foreign ecosystems — most often U.S.-authored — in market segments where scale benefits outweigh compliance costs.

Discipline: Treat integration as a transitional platform — a staging ground to amass resources, talent, and ecosystem alliances for a sovereign pivot.

Exit Triggers: Commit to pre-defined technical or market milestones at which integration dependency must decrease.

2. Parallel Sovereignty Development — Designing Your Own Grammar

Objective: Establish autonomous or regional executional substrates that safeguard long-term strategic sovereignty.

Method: Build operational grammars — cadence, standards, governance — interoperable enough to trade, yet self-governing at the core.

Anchor: Begin with sectors where you already possess industrial leverage, converting this into substrate authorship before foreign lock-in crystallizes.

Regional Pathways to Substrate Sovereignty

- Japan — Convert robotics and advanced manufacturing dominance into Industrial IoT operational standards; replace reliance on U.S.-authored data schemas before they become global defaults.

- South Korea — Match semiconductor fabrication leadership with an indigenous EDA toolchain and measurement standards to eliminate upstream substrate dependency.

- European Union — Use regulatory authority to establish green compliance substrates in mobility and energy; integrate industrial execution capacity to avoid ceding control to U.S. operational architectures.

The Strategic Payoff — ΔHHI as the Sovereignty Multiplier

Achieving substrate sovereignty transforms market participation into Market Architecture Ownership — a structural position where you write the rules of participation and capture disproportionate value.

High ΔHHI leverage signals this shift: bending global value pools, compliance logic, and innovation cadence toward your authored substrate, and monetizing not just products, but the very operating grammar of the industry.

“You either host the standard, or you are hosted by it.”

In the age of Ecosystemal Irreversibility, delay is not strategic patience — it is surrender by default.

“The time to act is measured not in decades, but in release cycles.”

Author the operating grammar now — or accept permanent subordination to those who do.

The End

© 2025 NYET, New York Institute of Entrepreneurship and Technology®

All rights reserved. This publication, including all text, data, graphics, and analytical frameworks herein, is the intellectual property of NYET, New York Institute of Entrepreneurship and Technology®. No part of this work may be reproduced, distributed, translated, adapted, stored in a retrieval system, or transmitted in any form or by any means — electronic, mechanical, photocopying, recording, or otherwise — without the prior written consent of NYET.

The concepts, models, and proprietary terms presented in this report, including but not limited to Ecosystemal Irreversibility™, Executional Substrate™, Market Architecture Ownership™, and ΔHHI Leverage™, are protected under applicable intellectual property laws and international treaties. Unauthorized use, citation without attribution, or incorporation into derivative works without permission constitutes infringement and may give rise to civil and criminal liability under U.S. and international law.

Requests for licensing, reproduction, or authorized use should be directed to:

Dr. Young D. Lee

Principal, NYET, New York Institute of Entrepreneurship and Technology®

📧 Dr.Lee@ket-nyet.org